CAGR Calculator – Growth Rate Calculator for Ecommerce

Mastering Growth Rates: A Simple Tool to Calculate Simple Growth Rate, CAGR, and Average Growth Rate

Understanding growth rates is essential for anyone involved in finance, business development, or investment. Whether you’re evaluating the performance of a business, planning for future growth, or assessing the potential return on investment, calculating growth rates accurately is key. Growth rates help you make informed decisions by showing how quickly a metric, such as revenue or profits, is growing over time.

To simplify this process, I’ve created a handy tool for calculating three of the most common growth rate metrics: Simple Growth Rate, Compound Annual Growth Rate (CAGR), and Average Growth Rate. This tool is perfect for entrepreneurs, financial analysts, investors, and anyone else looking to quickly analyze growth data.

Growth Rate Calculator Tool

You can use the calculator below to compute the Simple Growth Rate, Compound Annual Growth Rate (CAGR), and Average Growth Rate. Just enter your data and let the tool do the work for you. The default value is Revenue, but you can also use numbers for profit or turnover to get their specific growth rates.

Simple Growth Rate Calculator

Compound Annual Growth Rate (CAGR) Calculator

Average Growth Rate Calculator

Understanding the Different Types of Growth Rates

Now that you’ve seen how the tool works, let’s dive deeper into what each growth rate means and when to use them.

1. Simple Growth Rate

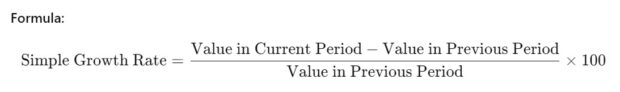

What is Simple Growth Rate?

Simple Growth Rate is the most straightforward way to measure growth between two periods. It calculates the percentage increase or decrease from one period to the next. This type of growth rate is often used to measure short-term growth, such as month-over-month or year-over-year changes.

Use Cases:

- Monthly or Quarterly Performance Analysis: Quickly assess the performance of a business, project, or investment over a short period.

- Sales and Marketing Metrics: Evaluate the growth of sales, customer acquisition, or web traffic.

- Tracking Specific Metrics: Useful when you need to track the growth of specific metrics like revenue, expenses, or customer base.

Example: If a company’s revenue increased from $100,000 to $120,000 in one year, the Simple Growth Rate is 20%.

2. Compound Annual Growth Rate (CAGR)

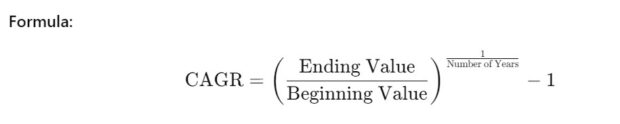

What is CAGR?

The Compound Annual Growth Rate (CAGR) is a more sophisticated metric that measures the mean annual growth rate of an investment, business metric, or financial figure over a specified period. Unlike the Simple Growth Rate, CAGR assumes the growth rate is compounded annually, which makes it more accurate for analyzing longer periods.

Use Cases:

- Investment Analysis: CAGR is widely used to evaluate the performance of investments such as stocks, mutual funds, or portfolios over time.

- Business Valuation: When valuing a company or forecasting future growth, CAGR provides a realistic picture of how the company’s financials might evolve.

- Comparing Growth Across Sectors: Useful for comparing the growth rates of different companies or sectors over the same period.

Example: If an investment grows from $10,000 to $15,000 over three years, the CAGR is approximately 14.47%.

3. Average Growth Rate

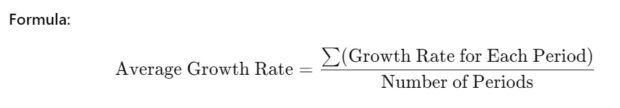

What is Average Growth Rate?

The Average Growth Rate calculates the arithmetic average of multiple growth rates over a given period. Unlike CAGR, it does not account for compounding. This makes it a simpler, but sometimes less accurate, way to calculate growth over time when the growth rate varies significantly.

Use Cases:

- Quick Estimates: Ideal for quick, back-of-the-envelope calculations where you need a rough estimate of growth over multiple periods.

- Non-Financial Metrics: Useful for calculating growth rates in metrics like user growth, engagement rates, or production outputs that don’t necessarily compound over time.

- Analyzing Fluctuating Data: When data points vary significantly, the average growth rate can provide a broad view of growth trends.

Example: If a company’s growth rates over three years are 10%, 20%, and 15%, the Average Growth Rate would be 15%.

Simple Growht Rate, CAGR & Average Growth Rate summarized

Understanding and accurately calculating growth rates are crucial for making informed decisions in business and finance. Whether you’re looking at the short-term growth of a project, the long-term returns of an investment, or comparing different growth scenarios, knowing which type of growth rate to use is vital.

The Growth Rate Calculator tool provided here simplifies the process, allowing you to calculate Simple Growth Rate, CAGR, and Average Growth Rate quickly and easily. Use this tool to enhance your analyses, forecast more accurately, and make better strategic decisions.

Feel free to try the tool out and bookmark if for easy access in the future, and let me know if you have any questions or need further insights into growth rates!