GM1, GM2 and GM3 in e-commerce

In the context of e-commerce, GM1, GM2, and GM3 are terms used to refer to different levels of Gross Margin, which measure profitability at various stages by accounting for different types of costs:

Continue reading or jump to the calculator.

What Are Gross Margins?

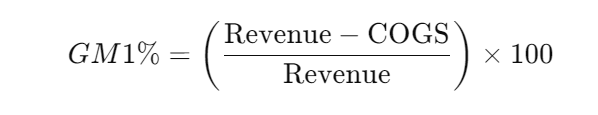

Gross Margin 1 (GM1):

GM1 is the difference between your revenue and the cost of goods sold (COGS), before taking into account any additional costs like fulfillment or advertising. It’s essentially your gross profit expressed as a percentage of your revenue. You usually know your COGS already, so GM1 should be really easy to calculate.

Formula:

This margin shows how well your products are priced relative to their cost. Discounts and changes in price affects GM1.

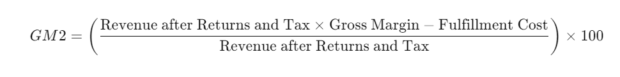

Gross Margin 2 (GM2):

GM2 takes GM1 a step further by subtracting fulfillment costs (packing and shipping). It represents the profit you make on each order before considering any marketing expenses.

Formula:

GM2 provides insight into your operational efficiency. Shipping campaigns like “free shipping” usually affects the GM2 negatively if it does not generate a lot of new orders. Optimizing your shipping prices or number of packages packed per hour makes your GM2 better.

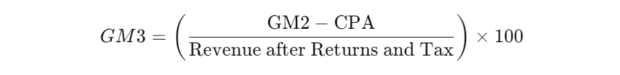

Gross Margin 3 (GM3):

GM3 is your final profit margin after deducting advertising costs (Cost per Acquisition, CPA). This is the net profit per order that contributes to your overall profitability. To know “CPA” you divide your marketing budget by the number of orders. CPA means “Cost per Acquisition” or “Cost per order”.

Formula:

GM3 is the most critical margin, showing the profitability of each order after all direct costs. Optimizing your advertising spend makes your GM3 better. Getting a larger share of orders through organic search, content, organic social and brand traffic also makes your GM3 better. Having to spend like crazy in Google Ads and META makes your GM3 worse. But often that is needed to get the volume needed.

GM3 should be positive enough to cover all your set costs like rent, IT, bookkeeping and salaries. If it does, you are cashflow positive, if not, you are burning more money than you get in.

GM3 needs to be positive. If it is positive, and you can scale without it becoming negative, you can calculate what the critical volume is before you are cashflow positive. To help you with this we have created a free GM1-2-3 calculator:

GM1 G2 GM3 Calculator

^^Take all your ads/marketing costs and divide it with the number of orders you have per month, and fill in this field.

Results

How to Use the GM1, GM2, GM3 Calculator

We’ve developed a simple yet powerful calculator to help you easily determine these margins and assess your e-commerce business’s financial health. Here’s an example to illustrate how the calculator works:

- Input Your Data:

- Average Order Value (including VAT and shipping fee, €): Enter the total value of a typical order.

- Tax Rate (%): The percentage of tax applied to your products.

- Return Rate (%): The percentage of orders that get returned.

- Gross Margin (%): The percentage margin between your selling price and COGS. This is GM1, you need to type in this manually. It is sually between 30 and 70 %. The higher the better.

- Fulfillment Cost (packing and shipping cost per order, €): The cost incurred for fulfilling each order. If you use a 3PL, you put in the cost of fulfillment per order + the cost of shipping here. If you have your own warehouse and packing personnel, you need to first calculate the salary cost of packing one order (total monthly warehouse personnel salary divided by number of packed orders for a normal month).

- Blended CPA (cost per order, €): The average ad spend & marketing spend required to acquire a single order. (divide marketing cost with number of orders)

- Set Costs (rent, salaries, hosting, etc., €): Your fixed monthly costs. Put the total in this field.

- Number of Orders per Month: The total orders you receive each month.

- Undersrtand the Results:

- Average Order Value (after tax/returns): This is your effective revenue per order after accounting for returns and taxes.

- GM2: Profit per Order (before ad costs, after fulfillment): This shows your profit margin after fulfillment costs but before ad spend.

- GM2 %: GM2 as a percentage of the effective revenue.

- GM3: Profit per Order (after ad costs, after fulfillment): This is your net profit per order.

- GM3 %: GM3 as a percentage of the effective revenue.

- Your Monthly Cashflow Now: This shows how much cash you generate monthly after all direct costs.

- Number of Orders Needed for Cashflow Positive: This indicates how many orders you need to break even. A really good KPi if you are still cashflow negative or if you plan on taking on more set costs.

Try the Calculator Now!

To make it easier for you to analyze your business’s performance, we’ve embedded the calculator directly into this blog post. Enter your data and see how your e-commerce business measures up.

Hopefully you got some new metrics to use for optimizing your e-commerce with the calculator.

Alternative way of labeling GM1, GM2 and GM3

Sometimes people want to merge GM2 and GM3 into GM2. Then they use “Set costs” for calculating GM3. You can do like that as well, but since set costs does not scale lineary with sales, it is not as useful for knowing your day to day profits. But if you want, here is the other way of thinking about GM1, GM2 and GM3:

- GM1 (Gross Margin 1): This is the most basic form of gross margin. It is calculated as the difference between revenue and the cost of goods sold (COGS), divided by revenue. Essentially, it reflects the profit made on products or services before accounting for any additional operating expenses, marketing, or administrative costs. The formula for GM1 is:GM1=(Revenue−COGSRevenue)×100GM1=(RevenueRevenue−COGS)×100COGS includes direct costs attributable to the production of the goods sold by a company.

- GM2 (Gross Margin 2): This metric extends beyond GM1 by subtracting additional variable costs associated with selling the products, such as payment processing fees, fulfillment costs, and direct marketing expenses related to selling those products. It provides a more detailed view of the profitability by considering more costs that directly impact the cost of selling a product. The formula for GM2 might look like: GM2=(Revenue−COGS−Variable CostsRevenue)×100GM2=(RevenueRevenue−COGS−Variable Costs)×100 Here, variable costs could include any expenses that vary directly with sales volume.

- GM3 (Gross Margin 3): This level of gross margin takes into account even more costs, including operational expenses such as overhead, administrative costs, and other indirect costs that are not included in GM2. GM3 provides an even broader perspective on the profitability of a business, reflecting the efficiency of the entire operation, not just the cost of selling products. The formula for GM3 might be:GM3=(Revenue−COGS−Variable Costs−Operational ExpensesRevenue)×100GM3=(RevenueRevenue−COGS−Variable Costs−Operational Expenses)×100

Each of these metrics provides a different level of insight into the financial health of an e-commerce business, allowing business owners and managers to make informed decisions about pricing, cost management, and strategic planning. GM1 focuses on the core profitability of products, GM2 provides insight into the costs associated with selling those products, and GM3 offers a comprehensive view of overall business efficiency.